Australian Government’s mandatory climate-related financial disclosures

- New reporting obligations

- Changes in 2023/24 to climate-related reporting: global and in Australia

- Key points for Australian organisations

- Implementation: disclosures and assurance rollout

- Your obligations: how we can help

- Questions?

New reporting obligations

The Australian Government’s new climate risk mitigation measures through mandatory climate-related financial disclosures come into effect from 1 January 2025. It is critical for organisations to understand their disclosure obligations and to get prepared.

These disclosures are designed to mitigate climate risk, and with decarbonising markets, present new opportunities for the business community.

We provide Mandatory Climate Reporting (MCR) Services to help you plan and meet MCR timelines. Please read on.

Changes in 2023/24 to climate-related reporting: globally and in Australia

At COP28 in UAE (November-December 2023) the Financial Stability Board (FSB) and the International Financial Reporting Standards (IFRS) announced that the Task Force on Climate-related Financial Disclosures (TCFD) had fulfilled its remit and disbanded. The responsibility for climate-related financial reporting now sits with the International Sustainability Standards Board (ISSB). Globally, the IFRS Foundation monitors the progress of climate-related disclosures.

And now Australia has brought in its own mandatory climate reporting system (MCR). And while TCFD had 11 disclosures, MCR will have more than 100, bringing with it a material uplift in climate-related practices and levels of assurance.

- Find more information about Australian Sustainability Reporting Standards here.

- Also see: Treasury: Mandatory climate-related financial disclosures.

Key points for Australian organisations:

- Rollout:

Initially MCR includes three groups:

Group 1 from FY 25/26.

Group 2 from FY 26/27.

Group 3 from FY 27/28.

- Applicability:

MCR laws will apply to most public companies and will likely include larger NFPs, and private and government entities (TBC by June 2024). Group 3 applicability will be subject to a materiality assessment. For more information, see the Treasury’s Policy Position Statement option 1b. - Liability:

Treasury is limiting Directors’ liability for the first three years of implementation.

Implementation: disclosures and assurance

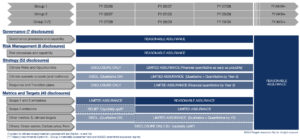

MCR obligations increase over a four-year period. The disclosures will address key areas of ongoing process and capability uplift, each with progressively increasing levels of scrutiny.

Indicative roll out

Your obligations: how we can help

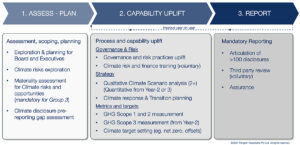

MCR is based on the four pillars of Governance, Strategy, Risk Management, and Targets and Metrics. Groups 2 and 3 may become involved early due to factors such as Group 1 value chain commitments, or consumer expectations for greater transparency. We advise our clients with reporting responsibilities to begin preparations as early as possible and to build up capability over three stages.

- Assessment: timing, scope, disclosure gap analysis, and planning.

- Uplift: governance and risk processes, strategy, and metrics and targets.

- Reporting: articulation of all disclosures, review and audit, and publishing.

Questions?

Contact us today about taking the first steps for your organisation. Talk to one of our climate specialists about an MCR consultation, presentation, or workshop. We take you through the processes, what to expect, and importantly, what questions you need to ask from your board, executives, and climate leaders.